quick download

INSTRUMENTS CHARGEABLE WITH STAMP DUTY

Rates of stamp duty:

All instrument enumerated in schedule 1 and 1-A of the India Stamp Act, 1899 (reproduced in this manual as appendix-I & II) whether executed out of India or in Punjab or out of Punjab and relates to any property situated or to any matter or thing done or to done in India or in Punjab and is received in India or in Punjab are chargeable with the duty of amount indicated in those schedules subject to the exemptions mentioned therein. (c.f. Section 3 Stamp Act)

Documents executed outside Punjab:

The duty in respect of the instruments mentioned in schedule I is uniform throughout India as they constitute the subject matter of Union legislations, but the duty in respect of the instruments mentioned in schedule I-A differs from state to state as they are in the state list under the constitution. As such, if a document mentioned in schedule I-A is executed outside the state of Punjab and is received in Punjab for being acted upon, it requires the duty prescribed for this state. For instance, an adoption deed executed on Stamp of Rs. 35 in the state of Bihar, who received in Punjab will require an additional duty of Rs.2.50P. as the duty in this state on such deed is Rs. 37.50P (c.f. Section 3(bb)

Several instruments used in single transaction:

Several instruments used in single transaction of sale, mortgage or settlement.- If in the case of any sale, mortgage or settlement, several instruments are employed for manual 9 completing the transaction, the principle instruments only shall be chargeable with the Stamp Duty prescribed in schedule 1-A for the conveyance, mortgage or settlement and each of other instruments shall be chargeable with a duty of five rupees instead of the duty (if any) prescribed for it in that schedule. (c.f. Section 4 Stamp Act)

Highest duty on principal instrument:

However, the duty chargeable on the instrument determined as the principal instrument by the party shall be highest duty, which is chargeable in respect of the said instrument employed. Example: - Two brothers having come to an agreement as to the settlement of their joint property, embodied the agreement in a deed which was duly stamped according to the value of the property indicated therein subsequently the parties to the deed executed a second deed of settlement which modified the provisions of the first in certain respects, but dealt with no property which was not covered by that document. Both deeds were contingent on the happening of events which at the time of the second deed were still future events. It was held that the first deed was liable to duty as settlements and the second under this section

Instruments relating to several distinct matters:

Any instrument comprising or relating to several distinct matters is chargeable with the aggregate amount of the duties with which separate instruments each comprising or relating to one such matters, are chargeable under the Stamp Act, (Section 5 of Stamp Act, 1899)

Section 5 provides for the determination of stamp duty on a multifarious instrument on an instrument relating to several distinct transactions manual 10 Example: - A bond was executed by sixteen persons each of whom borrowed a certain quantity of rice. They did not bind themselves to repay the debt, jointly and severally but each agreed thereby to repay the amount written against his name separately. The instrument comprised sixteen distinct contracts of loan and required the aggregate amount of duties which would have been payable if sixteen separate bonds were executed.

Instrument with in several descriptions:

Instrument coming within several descriptions in schedule I and I-A. An instrument so framed as to come within two or more descriptions in schedule I or schedule I-A and the duties chargeable thereunder are different, is chargeable only with the highest of such duties. (Section 6 of Stamp Act, 1899) Example:- In an instrument executed by a lessee, he agreed to take a lease of the property, make repairs pay a certain rent and not to quit the premises for a certain period. The deed was a lease as well as an agreement and under the above provisions, the higher duty either as lease or agreement is chargeable.

Stamp duty on registration outside Punjab :

Payments of the Punjab Stamp Duty or copies etc registered outside Punjab- If for completing a transaction of sale, mortgage or settlement several instruments have been employed and instead of the principal or the original instruments, a supplementary instrument, counterpart, duplicate or copy is received in Punjab, the difference between the enhanced duty as payable in Punjab and that already paid in respect of the principal or original instrument, shall be realized before any of the aforesaid instruments can be admitted in evidence (c.f. section 6-A Stamp Act, 1899) manual 11

FACTS AFFECTING DUTY AND DETERMINATION OF VALUE

Consideration and all other facts to be fully and set forth

The consideration (if any) and all other facts and circumstances affecting the chargeability of any instrument with duty on the amount of the duty with which it is chargeable, shall be fully and truly set forth therein (c.f. Section 27, Stamp Act, 1899) 6.2.

Under valuation of property: -

Although a Registrar before whom a document is presented for registration cannot embark on an independent enquiry regarding the value of property, yet he has power under section 35 of Stamp Act to refuse registration if the document is not duly stamped. Two courses are open to him. First of all if he, either from his own information or other wise suspect that the valuation given is under valuation with intent to cheat the Government of legitimate duty, he can ask for particulars from the party and if satisfied with it under valuation, can refuse to register the document unless proper duty was paid. Secondly in case where the document gets registered and the information is subsequently received that the valuation shown is under valuation and that the legitimate stamp duty has been intentionally awarded to defraud the state it will be open to registrar to initiate a prosecution under this section (section 27) read with section 64 of stamp Act.

(Comment of 11 under section 27 of Stamp Act, 1899 by T.D. Khurana)

Note:- Instances have come to the notice of the Government wherein parties have executed agreements in settlement of the value of the property to be sold, on higher value, but in the conveyance deed, the consideration has been shown less than actually transacted in the agreements for sale resulting in loss of stamp revenue. The manual 19 factum that agreement had been executed on higher value than the amount set forth in the conveyance deed is it itself a circumstancial place of evidence to establish the fraudulent intention of the parties as per memo No. 8132-ST-II-78/7540-41, dated 8th May, 1978 from Deputy Secretary to Government Punjab Revenue Department. All the Sub Registrars were requested to be very vigilant so that the parties do not adopt unlawful methods i.e. agreements and consult agreements deeds before registering the documents and if required, he (Sub- Registrar) may refer such like cases to the collector of District under Section 27 of the Indian Stamp Act, 1899, for taking necessary action under section 64 and 70 of the Act ibid

Instructions issued by Stamp and Registration Branch

|

Dated |

Subject |

Letter |

|

Instructions |

| |

|

10.8.1989 |

Embossment of Documents. | |

|

18.9.1989 |

Extension of the provisions of Section 118 of Transfer of Property Act 1882, to the Urban Areas of Punjab State. | |

|

16.1.2001 |

The Registration (Punjab Amendment) Act, 2000 (Punjab Act, no. 22 of 2000) | |

|

8.11.2001 |

The Registration and other Related Laws (Amendment)Act,2001, No. 48 of 2001 | |

|

2.1.2002 |

The Indian Stamps (Punjab Amendment) Act, 2001 (Punjab Act, no. 14 of 2001) | |

|

2.08.2002 |

Regarding the revision of the rates of copies and pasting fees | |

|

2.09.2002 |

The Punjab Stamp (dealing of under-valued instruments) (First Amendment), Rules, 2002 | |

|

4.9.2002 |

Amendment in para 127 of Punjab Registration Manual, 1929 | |

|

1.4.2003 |

Regarding revision of rate of discount to be paid to the Licensed Stamp Vendors for the sale of stamps and stamp papers | |

|

23.04.2003 |

Appointment of District Revenue Officers as ex-officio Inspectors of Registration offices | |

|

23.04.2003 |

Regarding revision of rates of scales of Document Writers | |

|

11.7.2003 |

Amendment in Rule 28 of the Punjab Stamp Rules, 1934 | |

|

22.7.2003 |

Withdrawal of exemption from stamp duty | |

|

14.1.2004 |

Exemption from Stamp Duty on deeds relating to transfer of agricultural lands and residential properties by the owner during her life time to her legal heirs. | |

|

6.2.2004 |

Rates of Stamp duty on instrument falling under Schedule-1 of the Indian Stamp Rules,2003 | |

|

19.3.2004 |

Payment of Commission to the Department of Posts on account of Service rendered for the sale of Revenue Stamps. | |

|

5.7.2004 |

Amendment in para 127 of Punjab Registration Manual, 1929 | |

|

13.7.2004 |

Sale of non-judicial impressed sheets through Post Offices | |

|

13.7.2004 |

The Indian Stamp (Punjab Amendment), Act, 2003 (Punjab Act No. 15 of 2004) | |

|

18.8.2004 |

Exemption of Stamp duty on issuance bills of exchange used by exporters. | |

|

10.9.2004 |

The Registration (Punjab Amendment) Act, 2004 (Punjab Act no. 20 of 2004) | |

|

18.2.2005 |

Payment of consolidation Stamp Duty on Policies of Life Insurance Corporation of India in lieu of Insurance Stamps | |

|

3.3.2005 |

Additional Stamp Duty @3% in areas falling under Municipalities and Municipal Corporations and their periphery for Social Security Fund. | |

|

1.4.2005 |

Remission of stamp duty and registration fee on inter-se agreement executed by the members of Self Help Group under the Scheme of the Bankers which is only meant for people living below poverty line. | |

|

1.4.2005 |

Additional Stamp Duty @3% in areas falling under Municipality and Municipal Corporations and their periphery for Social Security Fund. | |

|

17.10.2005 |

Exemption of Stamp duty on issuance bills of exchange used by exporters. | |

|

13.6.2005 |

Additional Stamp Duty @3% in areas falling under Municipality and Municipal Corporations and their periphery for Social Security Fund. | |

|

8.11.2005 |

Rates of Stamp Duty on instrument falling under Schedule-I ofthe Indian Stamp Act, 1899. | |

|

23.12.2005 | ||

|

9.1.2006 |

Filling of the annual information return regarding the sale-purchase of 30 Lakh Rupees. | |

|

22.11.2006 |

Payment of consolidated stamp duty on policies of Life Insurance Corporation of India in lieu of Insurance Stamps. | |

|

22.11.2006 |

Exemption from Stamp duty on deeds relating to transfer of agricultural lands and residential properties by males in favour of their wives (instead of widows). | |

|

8.2.2006 |

Rates of Stamp Duty on instrument falling under Schedule-1 of the India Stamp Duty Act,1899 | |

|

17.2.2006 |

Regarding issue of new lances to Document Writers. | |

|

5.6.2006 |

Amendment to the India Stamp Act, 1899 through the Finance Act, 2006 | |

|

6.6.2006 |

Exemption from payment of Stamp Duty and Registration fee on any deed of mortgage without possession executed by an officer or employee of the Government of Punjab. | |

|

17.7.2006 |

Authorization by State Government in favour of Ministry of Company Affairs in connection with MCA-21 Project. | |

|

3.5.2007 |

Exemption from payment of Stamp Duty in case of transfer of residential within family in urban areas. | |

|

1.10.2007 |

The Indian Stamp (Punjab Amendment) Ordinance, 2007 – (Punjab Ordinance Act No. 5 of 2007) | |

|

18.8.2009 |

| |

|

26.8.2009 |

| |

|

22.9.2009 |

| |

|

24.12.2009 | ||

|

7.1.2010 |

| |

|

27.1.2010 | ||

|

19.2.2010 |

Regarding the Grant of Exemption from Stamp Duty to Mega Projects) | |

|

11.2.2010 |

Amendment order regarding reduction of Stamp Duty for female buyers | |

|

22.2.2010 |

| |

|

15.3.2010 |

| |

|

17.3.2010 |

Amendment order regarding residential property | |

|

30.3.2010 |

| |

|

31.3.2010 |

Registration of immoveable property on allotment rates | |

|

1.4.2010 | ||

|

5.7.2010 |

Grant of exemption from stamp duty with respect to the instruments specified in schedule 1-A of Indian Stamp Act, 1899 of Mega Project, approved by the Empowered Committee. | |

|

30.7.2010 |

Grant of exemption of Stamp Duty and registration fee with respect to the instruments related to Industrial Park and IT Parks. | |

|

5.8.2010 |

Embossing of document. |

22/1/88-ST-VI/12403-26, |

|

6.8.2010 |

Regarding Section 118 of Transfer of Property Act, 1882 | |

|

3.10.2011 |

Regarding the charges of stamp duty in case of allotment of property by the Govt./Semi Govt organization. | |

|

25.10.2011 |

Regarding the presence of Registry officials at the time of registration. | |

|

7.12.2011 |

Regarding the supply of nakals of registered documents within 7 days. | |

|

14.09.2012 |

Instructions regarding Random Checking of Sale Deeds registered on daily basis. | |

|

27.9.2012 |

Instructions regarding Random Checking of Sale Deeds registered on daily basis. | |

|

14.05.2013 |

Instructions regarding Embossing of Power of Attorney. | |

|

24.07.2014 |

Regarding the issuance of licence of Stamp Vendors. | |

|

24.07.2014 |

Regarding the entry of Sale Certificate of the property sold through auction into the Land Records. | |

|

06.08.2014 |

Guidelines regarding the registration of Mortgage of Deeds(Aad Rehan)- Amendment in Punjab Agriculture Credit Operations and Miscellaneous Provisions (banks) Act, 1978. | |

|

29.08.2014 |

Regarding exemption of Stamp Duty & Registration fees on documents of Gift/Sale deed in favour of Charitable Institutes. | |

|

29.08.2014 |

Regarding relief of Stamp Duty on purchase of land by females. | |

|

04.09.2014 |

Regarding placing the List of villages falling within the area of five kilometres from the outer limit of the Municipality or corporation in the Offices of Sub Registrars. | |

|

27.10.2014 |

Regarding the simplification of the process for registration of Mortgage of Deeds (Aad Rehan). Amendment in the “The Punjab Agriculture Credit Operations & Miscellaneous Provisions Banks) Act 1978” | |

|

21.01.2015 |

Implementation of E-stamping system in Punjab. | |

|

04.02.2015 |

Regarding the complete information of property in the Sale deed. | |

|

13.08.2015 |

Regarding the complete information of property in the Sale deed. | |

|

25.08.2015 |

Regarding the complete information of property in the Sale deed. | |

|

18.04.2016 |

Regarding revision of Collector Rates. |

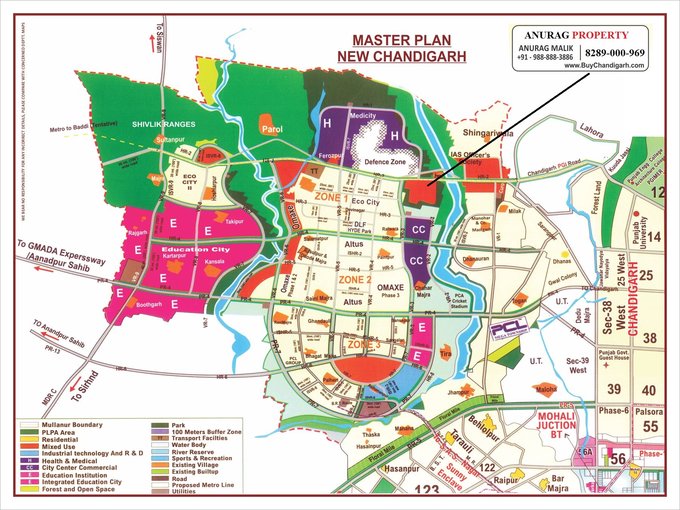

NEW CHANDIGARH LATEST MASTER PLAN